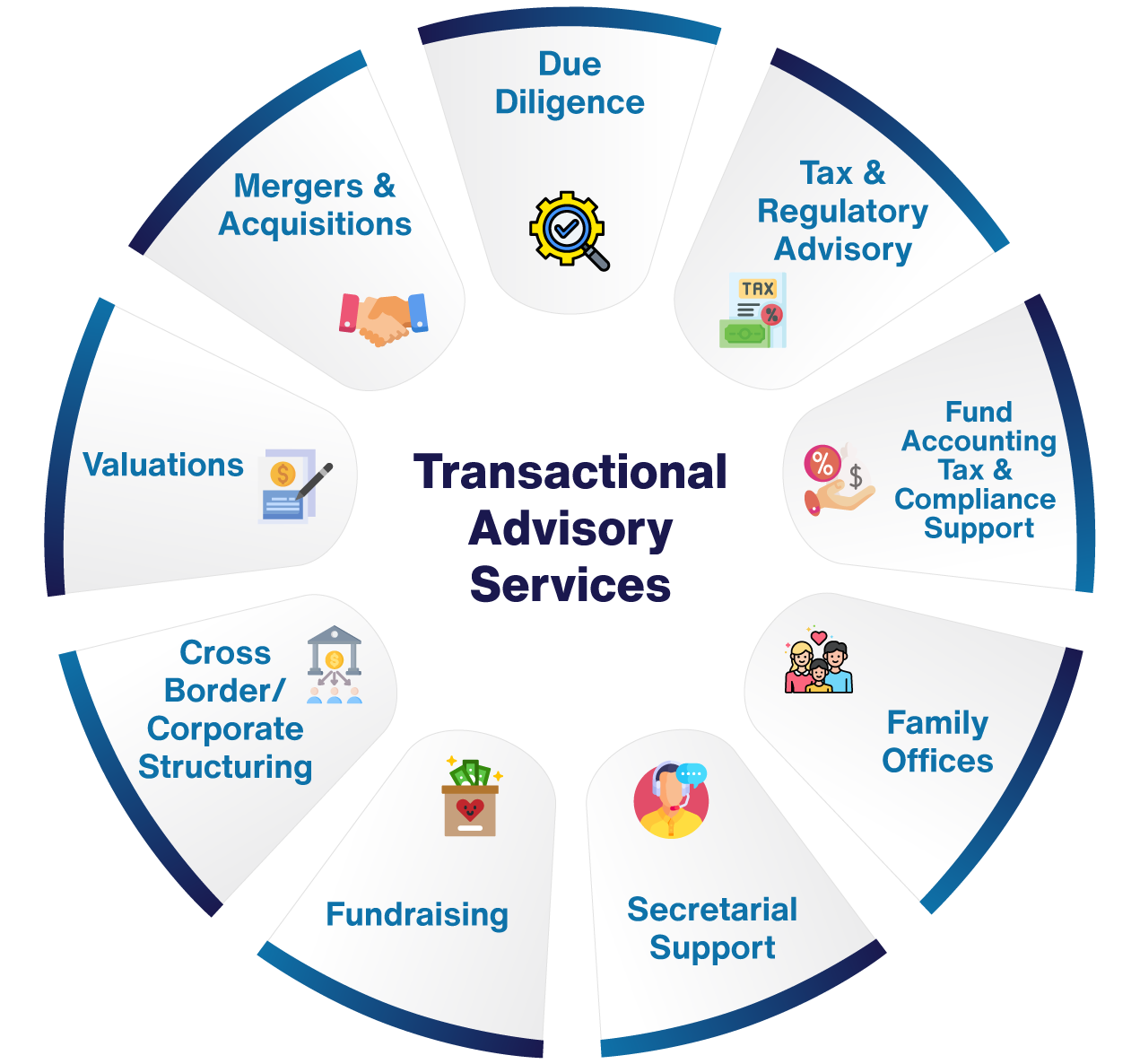

Transaction Advisory Services Things To Know Before You Buy

Wiki Article

5 Simple Techniques For Transaction Advisory Services

Table of ContentsOur Transaction Advisory Services DiariesThe 15-Second Trick For Transaction Advisory ServicesLittle Known Questions About Transaction Advisory Services.Some Known Incorrect Statements About Transaction Advisory Services The Basic Principles Of Transaction Advisory Services

This action ensures business looks its finest to possible buyers. Obtaining business's worth right is vital for an effective sale. Advisors utilize various approaches, like discounted money circulation (DCF) evaluation, comparing to similar business, and current deals, to determine the reasonable market price. This aids set a fair cost and work out efficiently with future purchasers.Transaction consultants action in to assist by obtaining all the required details organized, addressing concerns from buyers, and setting up check outs to business's location. This constructs depend on with buyers and maintains the sale moving along. Obtaining the very best terms is crucial. Deal experts use their proficiency to help entrepreneur handle tough negotiations, satisfy purchaser assumptions, and framework bargains that match the proprietor's objectives.

Satisfying lawful rules is crucial in any type of business sale. Transaction advisory services deal with legal experts to develop and review contracts, contracts, and various other legal papers. This minimizes threats and makes sure the sale follows the regulation. The duty of transaction consultants extends past the sale. They aid local business owner in intending for their following actions, whether it's retirement, beginning a brand-new venture, or managing their newfound wide range.

Transaction advisors bring a riches of experience and expertise, guaranteeing that every facet of the sale is dealt with skillfully. With calculated prep work, assessment, and settlement, TAS assists service owners attain the greatest feasible price. By making certain legal and governing conformity and managing due diligence along with other deal employee, purchase advisors reduce potential threats and responsibilities.

Our Transaction Advisory Services Statements

By contrast, Big 4 TS teams: Service (e.g., when a possible buyer is conducting due persistance, or when an offer is closing and the customer needs to integrate the company and re-value the vendor's Annual report). Are with costs that are not connected to the bargain shutting efficiently. Make costs per interaction someplace in the, which is much less than what financial investment financial institutions gain also on "small offers" (yet the collection chance is also much higher).

, yet they'll focus a lot more on accounting and assessment and less on topics like LBO modeling., and "accounting professional only" topics home like trial equilibriums and exactly how to stroll through events utilizing debits and credit scores rather than economic statement modifications.

The Greatest Guide To Transaction Advisory Services

Professionals in the TS/ FDD groups may also interview monitoring regarding everything above, and they'll create an in-depth record with their searchings for at the end of the process.The pecking order in Deal Services varies a bit from the ones in financial investment banking and private equity jobs, and the basic shape resembles this: The entry-level function, where you do a great deal of data and economic analysis (2 years for a promo from right here). The following degree up; similar job, however you obtain the even more interesting bits (3 years for a promotion).

Particularly, it's tough to get promoted past the Manager degree because few individuals leave the job at that phase, and you require to start revealing evidence of your capacity to generate profits to advancement. Allow's begin with the hours and way of life since those are less complicated to explain:. There are periodic late evenings and weekend work, yet nothing like the frenzied nature of financial investment financial.

There are cost-of-living changes, so anticipate lower compensation if you're in a more affordable location outside major economic centers. For all positions other than Companion, the base income consists of the bulk of the overall payment; the year-end incentive may be a max of 30% of your base pay. Typically, the ideal means to boost your earnings is to change to a various company and discuss for a higher wage and perk

Not known Facts About Transaction Advisory Services

You could enter company development, but investment banking gets harder at this go now phase because you'll be over-qualified for Expert functions. Corporate money is still an option. At this phase, you must just remain and make a run for a Partner-level function. If you wish to leave, possibly relocate to a client and perform their appraisals and due diligence in-house.The major issue is that because: You normally need to sign up with an additional Huge 4 group, such as audit, and job there for a few years and after that move right into TS, job there for a few years and then relocate right into IB. And there's still no assurance of winning this IB function because it depends upon your region, clients, and the hiring market at the time.

Longer-term, there is additionally some threat of and since evaluating a business's historic monetary information is not precisely rocket science. Yes, human beings will certainly always require to be involved, yet with advanced technology, lower headcounts could possibly sustain client interactions. That stated, the Purchase Solutions group beats audit in regards to pay, job, and departure possibilities.

If you liked this short article, you might be thinking about analysis.

Not known Incorrect Statements About Transaction Advisory Services

Create advanced economic frameworks that assist in determining the real market price of a company. Offer advising operate in relation to business valuation to assist in negotiating and rates frameworks. Discuss one of the most appropriate form of the deal and the kind of factor to consider to utilize (money, supply, gain out, and others).

Do integration preparation to determine the procedure, system, and organizational adjustments that may be required after the deal. Set standards for integrating departments, technologies, and service procedures.

Recognize possible reductions by minimizing DPO, DIO, and DSO. Assess the potential consumer base, sector verticals, and sales cycle. Take into review consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance supplies crucial understandings into the functioning of the firm to be obtained concerning danger analysis and worth production. Identify short-term adjustments to finances, banks, and systems.

Report this wiki page